Businesses constantly struggle with fragmented and outdated customer information, making managing risks and offering personalized services difficult. This issue contributes to significant financial losses, with online payment fraud costing the e-commerce industry an estimated $48 billion annually.

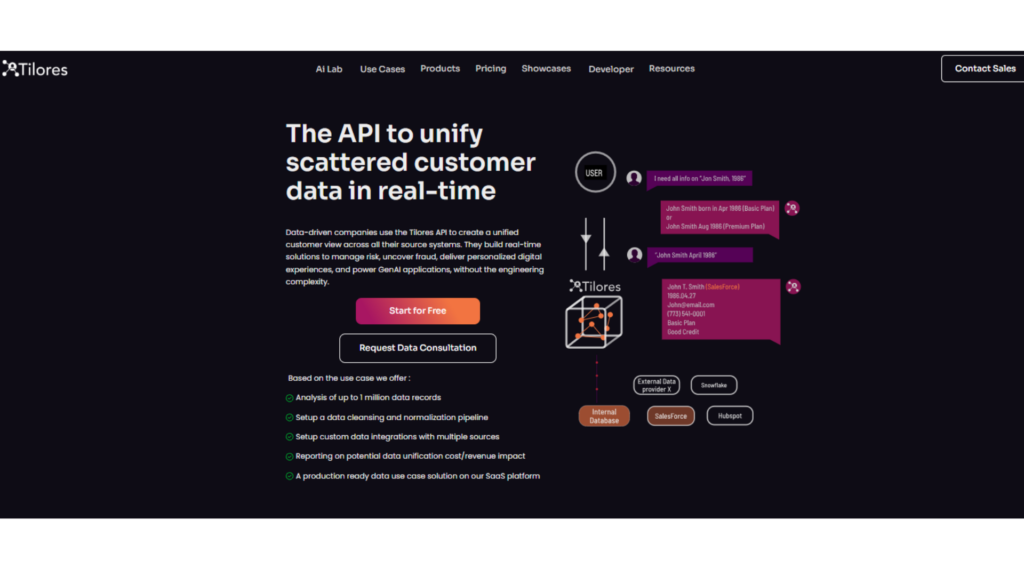

From my experience working with data management and fraud prevention tools, I understand the impact of unreliable customer records on business operations. Tilores offers a solution by providing an API consolidating scattered data in real time.

Linking information from multiple sources helps organizations build detailed customer profiles, improving fraud detection and overall service quality.

This review will examine how Tilores streamlines data unification, supports large-scale operations, and simplifies complex workflows without requiring extensive technical resources.

We will explore its core features, practical applications, and potential benefits for businesses aiming to refine their data strategies while minimizing risks.

What is Tilores?

Tilores is an advanced entity resolution and data unification platform built to help businesses consolidate fragmented customer information in real time.

Connecting data from multiple sources removes duplicate records and creates a single, reliable profile for each entity. This solution is valuable for organizations handling large amounts of information, such as financial institutions, e-commerce platforms, and fraud prevention teams.

Core Functionality and Purpose

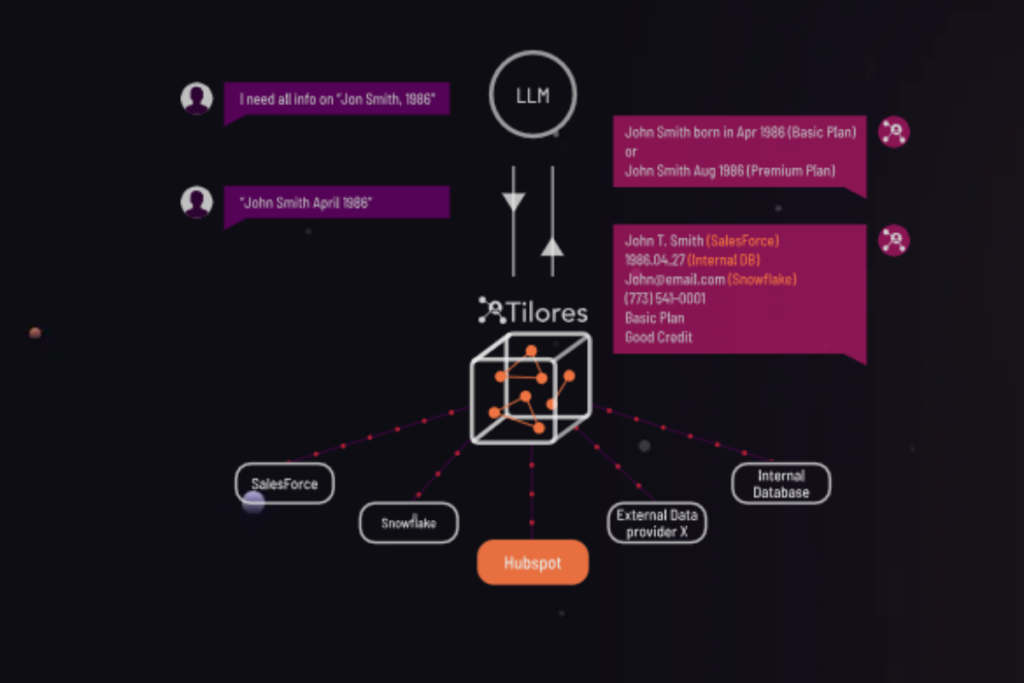

Tilores specializes in real-time entity resolution, meaning it identifies and links related records across different databases, even when details are inconsistent or incomplete. The platform uses a graph-based data model, allowing it to map connections between data points quickly and accurately.

Tilores integrates with existing systems through an API, allowing businesses to process large volumes of information without extensive technical adjustments.

Automating data linking and removing duplicate entries reduces errors, increases efficiency, and provides businesses with the most current and accurate records.

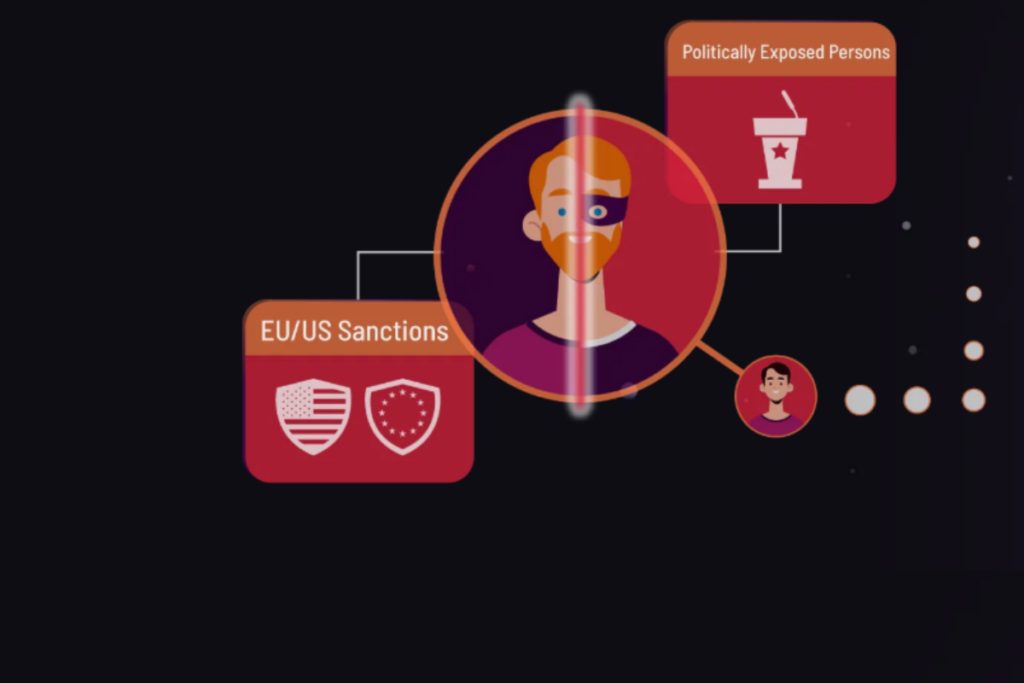

Another key function of Tilores is fraud detection and risk analysis. Gathering data from different sources helps companies recognize suspicious patterns, prevent identity fraud, and meet compliance requirements.

Who Uses Tilores?

Tilores is designed for businesses and organizations that need structured and well-connected customer information to make informed decisions. It is beneficial for:

- Financial Services & Banking – Supports fraud prevention, KYC (Know Your Customer) processes, and compliance with regulatory guidelines.

- E-commerce & Retail – Helps detect fraudulent transactions, manage customer identities, and prevent duplicate accounts.

- Insurance Providers – Assists risk evaluation by linking customer data across multiple sources to identify false claims.

- Government & Law Enforcement – Helps with identity verification, background checks, and fraud investigations.

- Marketing & CRM Teams – Combining customer records allows businesses to develop more personalized and accurate marketing campaigns.

Key Features and Benefits

Real-Time Data Unification: Unlike batch-processing solutions, Tilores operates instantly, allowing businesses to work with the most up-to-date records.

Scalability and Performance: Built to handle large datasets efficiently, Tilores is well-suited for businesses managing millions of records.

Graph-Based Data Model: Uses an advanced approach to mapping connections, leading to higher accuracy in entity resolution.

Seamless API Integration: Works with existing systems without requiring major structural changes.

Fraud Prevention and Risk Reduction: Links customer data across different sources to detect fraudulent activity and improve security.

Regulatory Compliance: Helps businesses meet legal requirements related to customer verification and data privacy.

Tilores provides a practical solution for companies struggling with scattered information. Creating unified customer profiles and identifying links between different data points improves decision-making, strengthens security, and simplifies data management.

Tilores Pros and Cons

Tilores provides a structured approach to managing large-scale customer data, offering a range of capabilities for businesses that need accurate and connected records. While it has several advantages, some challenges may affect usability depending on an organization’s needs.

Pros

- Processes Data in Real Time – Updates and resolves entity records instantly, keeping information accurate and current.

- Handles Large Data Volumes – Built for businesses that manage millions of records without slowing down performance.

- Graph-Based Structure – Strengthens the accuracy of identifying relationships between different data points, reducing duplicate or conflicting records.

- Connects with Other Systems – API-based design allows it to work within existing infrastructures without requiring major adjustments.

- Improves Fraud Detection – Helps businesses recognize suspicious activity by linking data across multiple sources.

Cons

- Requires Technical Knowledge – While well-documented, organizations without experienced developers may need additional resources for setup and maintenance.

- Variable Pricing – Costs may shift depending on data volume, making long-term budgeting less predictable.

- No Standalone Interface – Primarily built for API-based integration, which may not suit teams looking for a ready-to-use visual platform.

Tilores serves organizations that need an efficient way to unify and process data while maintaining accuracy. Before adopting the platform, businesses should evaluate whether their technical capacity and pricing expectations align with its model.

Tilores Expert Opinion & Deep Analysis

Tilores takes a unique approach to entity resolution and data unification. When compared to other solutions in this space, it becomes clear where it stands out and where adjustments might be needed.

Strengths of Tilores

Many platforms handle entity resolution using batch processing, which means updates occur periodically. Tilores operates in real-time, allowing businesses to work with continuously updated data.

This is especially valuable for fraud detection, identity verification, and regulatory compliance, where delays can create security risks. Another key strength is the graph-based structure. Many systems rely on rule-based matching, which often struggles with incomplete or inconsistent data.

Tilores connects records dynamically, making it more effective for businesses that need accuracy across various datasets. Large datasets often create bottlenecks in traditional systems, but Tilores processes millions of records efficiently.

Businesses can maintain data accuracy without investing in additional engineering resources, reducing operational overhead.

Areas That May Present Challenges

The API-based approach provides flexibility but may require technical expertise during setup. Some other platforms, such as Clearbit or FullContact, offer ready-to-use dashboards, making them easier for teams without development experience.

Costs may fluctuate depending on data volume, which could make budgeting more complex. Businesses with a fixed budget might prefer solutions with tiered pricing that provide more predictable expenses.

Tilores also focuses primarily on integration rather than providing a standalone interface. This makes it a strong option for companies with existing data workflows but may not be the best fit for those looking for a no-code or low-code tool.

Best Use Cases

- Fraud Prevention in Financial Services – A bank or fintech company processing thousands of transactions daily can benefit from real-time entity resolution to flag duplicate identities and prevent fraudulent activities.

- Customer Identity Management in E-Commerce—Online marketplaces that deal with multiple customer accounts, shipping addresses, and email formats can unify customer data to create more accurate profiles.

- Regulated Industries – Businesses that need to meet KYC (Know Your Customer) or AML (Anti-Money Laundering) regulations can use Tilores to verify identities and maintain compliance.

Who Might Consider Other Options?

- Small Businesses Without a Development Team – Companies without in-house technical support may find platforms with built-in dashboards easier to implement.

- Organizations Needing Fixed Pricing – Some businesses prefer platforms with a clear cost structure rather than one based on usage.

- Teams Looking for a Visual Interface – Companies that want a low-code or no-code solution may find other options better suited to their needs.

Tilores offers a strong solution for businesses handling high volumes of data and requiring real-time accuracy. It is well-suited for industries focused on fraud prevention, risk assessment, and identity verification.

The ability to efficiently unify data from different sources makes it a strong contender in this category. While implementing it may require some technical effort, the benefits make it a worthwhile investment for organizations that need precise and scalable data management.

Tilores Key Features

Tilores offers a structured approach to managing and unifying entity data, helping businesses maintain accuracy and efficiency. Below is a detailed look at its core capabilities and how they support data-driven operations.

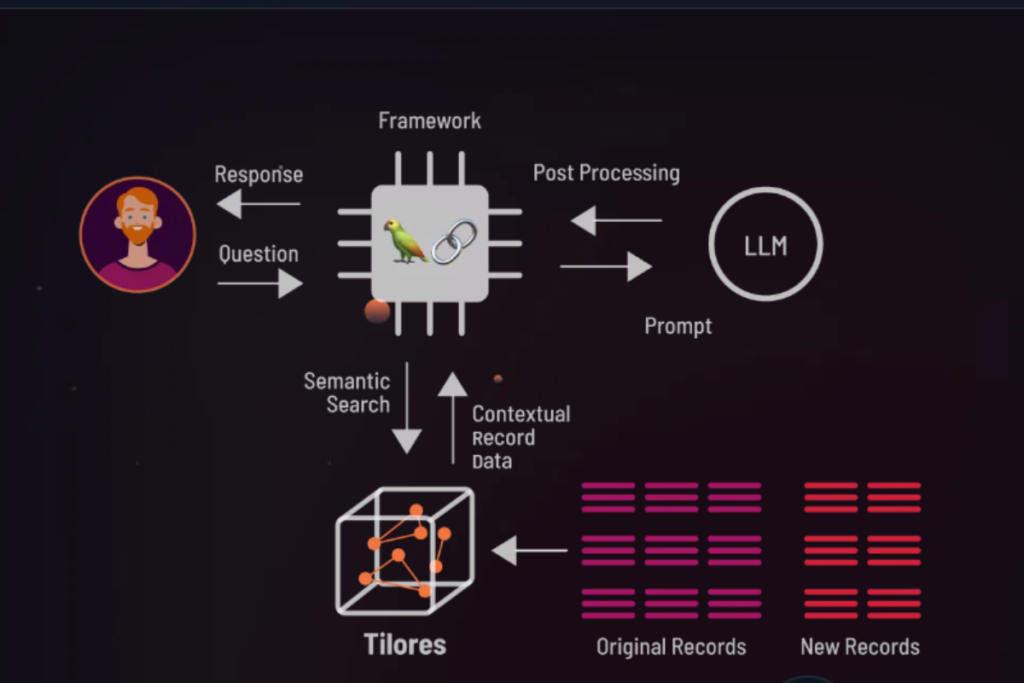

1. Retrieval-Augmented Generation (RAG)

Tilores process information as it comes in, ensuring records are always up to date. This is especially useful for fraud detection, compliance checks, and customer identity management, where delays in updating records can create security risks.

Connecting data dynamically minimizes duplicate or inconsistent records, giving businesses a clearer view of their customers and operations.

2. Advanced Identity Resolution

Many traditional data resolution tools rely on rule-based matching, which can miss connections when incomplete information is inconsistent. Tilores applies a graph-based approach, recognizing relationships across multiple data points.

This improves accuracy by linking related records even when names, addresses, or identifiers vary slightly. Businesses handling large sets of customer data benefit from fewer duplicates and better connections between records.

3. Data Unification

Tilores is built to handle millions of records without slowing down performance. Many organizations face challenges as their data grows, leading to delays and increased processing time.

Tilores is structured to handle expanding datasets efficiently, making it well-suited for industries like finance, retail, and government services that process large volumes of data daily.

4. Seamless API Integration

Tilores is designed to work smoothly with existing business systems. Its API allows companies to integrate entity resolution into their workflows without major system overhauls.

This flexibility makes it a strong choice for teams that require customized data processing without being restricted to pre-built interfaces. Businesses can use Tilores to refine their data processes while keeping their current tools in place.

5. Fraud Detection and Risk Management

With the ability to connect data across multiple sources, Tilores helps identify suspicious activity in real-time. Duplicate identities, inconsistent records, and unusual transaction patterns are flagged automatically, reducing the chances of fraud slipping through unnoticed.

Companies in finance, e-commerce, and compliance-heavy industries benefit from an automated system that strengthens security while cutting down on manual reviews.

6. Regulatory Compliance Support

Tilores assists businesses in meeting legal requirements related to data accuracy, identity verification, and fraud prevention. Compliance with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations requires consistent and well-organized records.

By linking scattered data points and verifying identities, Tilores simplifies compliance efforts, helping businesses avoid penalties and operational risks.

Tilores Pricing

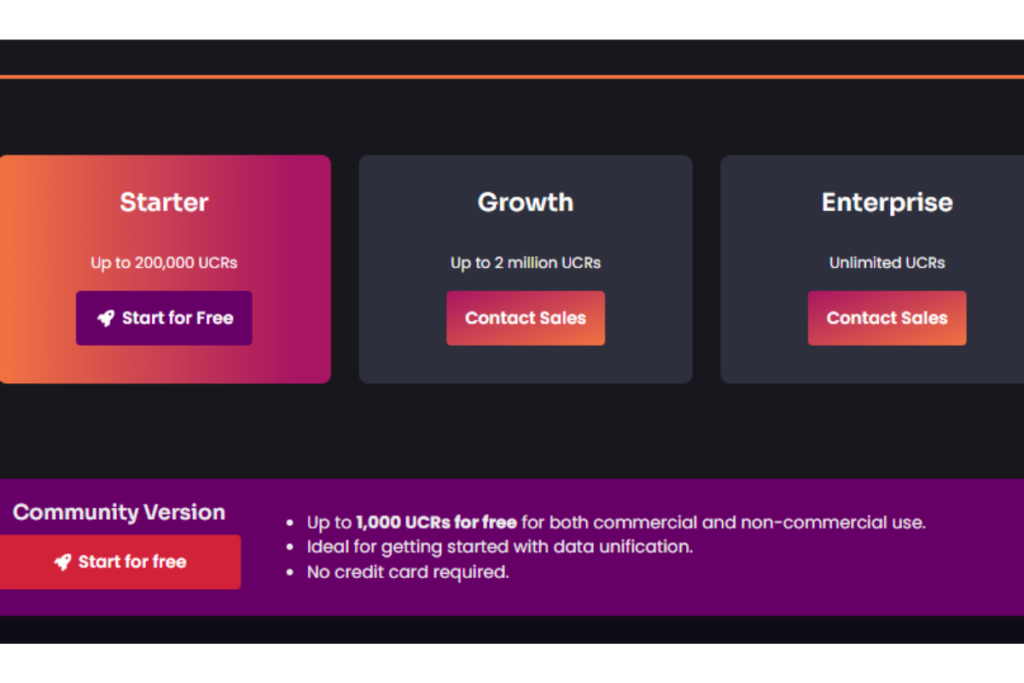

Tilores offers multiple pricing plans suited for different business needs. The structure is based on the number of Unique Customer Records (UCRs) processed, making it adaptable for startups, growing companies, and large enterprises.

Pricing Plans

| Plan | UCR Limit | Pricing | Best For |

|---|---|---|---|

| Community Version | Up to 1,000 UCRs | Free | Individuals and small teams exploring data unification |

| Starter | Up to 200,000 UCRs | Start for Free | Small businesses looking for an entry-level plan |

| Growth | Up to 2 million UCRs | Contact Sales | Mid-sized businesses handling large datasets |

| Enterprise | Unlimited UCRs | Contact Sales | Organizations processing massive amounts of data |

Overview of Pricing

- Community Version—This version allows up to 1,000 UCRs at no cost. It is an ideal starting point for those testing data unification without financial commitment.

- Starter Plan: This plan supports up to 200,000 UCRs and is free, making it accessible to small businesses.

- Growth Plan: This plan provides capacity for up to 2 million UCRs. Businesses should contact sales to receive a quote.

- Enterprise Plan – Offers unlimited UCRs for large-scale data processing.

Since Growth and Enterprise plans require consultation, businesses that need fixed pricing for budgeting may need to obtain cost estimates.

Tilores Use Cases

Tilores is designed for companies handling large amounts of customer data. It supports industries focused on fraud prevention, compliance, and data accuracy.

Fraud Detection and Security

Banks, financial services, and e-commerce businesses require precise data to reduce fraudulent activities. Tilores connects scattered records to identify duplicate identities, flag unusual behavior, and prevent unauthorized transactions.

A fintech company managing thousands of daily transactions can integrate Tilores to detect linked accounts, reducing fraud risks before issues arise.

Customer Identity Management for E-Commerce

Retailers and online marketplaces often deal with duplicate customer accounts, inconsistent shipping addresses, and variations in user information. Tilores merges fragmented customer profiles, creating a single, accurate view.

This helps businesses reduce redundant records, prevent fraud, and provide better customer service. A company managing millions of customer interactions can apply Tilores to connect data from multiple sources, improving operational efficiency.

Regulatory Compliance for Finance and Healthcare

Many industries must comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. Tilores consolidates identity records from different sources, making it easier to meet legal requirements.

Healthcare providers managing patient records across various locations can use Tilores to unify data, ensuring consistency and reducing administrative errors.

Marketing and CRM Optimization

Businesses relying on customer data for marketing campaigns need accurate and well-organized records. Tilores helps eliminate duplicate profiles and link related customer records.

A digital marketing firm managing client data from different platforms can use Tilores to improve audience segmentation and campaign accuracy.

Government and Law Enforcement Applications

Public agencies and law enforcement require reliable identification systems for background checks, crime investigations, and social programs. Tilores helps unify identity records across multiple databases, reducing discrepancies.

A law enforcement agency conducting background checks can apply Tilores to cross-reference records across different jurisdictions, improving data accuracy. Tilores supports businesses that prioritize fraud detection, data accuracy, and compliance.

Companies with high volumes of customer records benefit the most, while those looking for a plug-and-play tool with fixed pricing might need a different approach.

Tilores Support

Tilores is an API-based platform that offers flexibility for integration but requires technical knowledge for setup. The system focuses on functionality rather than a traditional user interface, making it more suitable for teams with development experience.

Ease of Use

Tilores is structured for businesses needing a high-performance solution for data unification. Since it operates through an API, it does not include a visual dashboard or drag-and-drop features.

Users must integrate it with existing systems and configure it based on specific workflows. The onboarding experience depends on the technical background of the team handling implementation.

Comprehensive documentation is available, guiding setup and best practices. For those familiar with APIs and entity resolution, the process is straightforward. Businesses without development expertise may require additional resources or support to complete integration successfully.

Customer Support and Resources

Tilores offers multiple support options to assist users at different levels:

- Documentation and Developer Guides – A knowledge base that provides technical instructions, setup details, and best practices.

- Community Support – The free version allows users to test features and discuss with others working on similar implementations.

- Direct Support for Paid Plans—Businesses using Growth or Enterprise plans can seek direct assistance. Response times may depend on the level of support included in the plan.

Since Tilores is focused on API-driven data processing, most support resources cater to technical users. Organizations without in-house developers may need to allocate additional time or external expertise to implement the system effectively.

Tilores provides well-structured documentation and support options, though its usability depends on the technical capabilities of the integration team.

Businesses with experienced developers will find it a flexible solution, while those looking for a no-code interface may need to evaluate whether the learning curve aligns with their needs.

Tilores Integrations

Tilores is built as an API-driven platform, allowing it to connect with various business applications and data management systems.

Its primary function is streamlining entity resolution across multiple platforms, helping businesses unify scattered records and improve data accuracy.

Integration Capabilities

Tilores works with various business applications, supporting automation and efficient data management. Some of the key integration possibilities include:

- Customer Relationship Management (CRM) – Connects with Salesforce, HubSpot, and Microsoft Dynamics to consolidate customer records and reduce duplicate entries.

- Fraud Detection and Security Tools – Works with financial risk management software used by banks and e-commerce businesses to identify transaction patterns and prevent fraudulent activity.

- Enterprise Resource Planning (ERP) – Helps maintain structured and accurate records across business units, ensuring customer and vendor information consistency.

- Data Warehouses and Business Intelligence Tools – Works with AWS, Google Cloud, and Snowflake, synchronizing data for better reporting and analytics.

- Custom API Integrations – Businesses with proprietary systems can connect Tilores to internal databases, adapting it to specific workflows.

Workflow Benefits

Tilores strengthens data consistency by resolving duplicate records and linking related entities across multiple platforms. This improves efficiency in fraud prevention, customer identity management, and compliance reporting.

For example, when used in financial services, Tilores helps detect account duplication across different systems, reducing security risks. In marketing and CRM, accurate data unification allows for better segmentation, leading to more precise customer outreach.

Compatibility

Since Tilores is API-based, it does not rely on a specific operating system or device. It functions within cloud environments and works with any system that supports API connections.

Businesses using Windows, macOS, or Linux can integrate Tilores into their workflows without needing additional software or hardware adjustments. Tilores is structured to connect with a broad range of business applications, making data unification more efficient and reliable.

Its ability to process large volumes of records across multiple platforms helps organizations maintain consistency and improve decision-making.

Tilores FAQs

Tilores helps businesses manage and unify large datasets. Below are common questions about its features, pricing, and support.

1. What are Tilores used for?

Tilores connects fragmented customer data, removes duplicate records, and helps detect fraud in real time. It is widely used in finance, e-commerce, and industries that require accurate data management.

2. Is there a free version available?

Yes, the Community Version allows businesses to process up to 1,000 Unique Customer Records (UCRs) at no cost, making it a practical option for those testing its capabilities.

3. How does Tilores integrate with other systems?

Tilores connects through an API, making it compatible with CRM platforms, ERP systems, fraud detection tools, and data warehouses such as Salesforce, Microsoft Dynamics, AWS, and Snowflake.

4. What types of support are available?

Tilores provides documentation, a community forum, and direct assistance for paid plans. Growth and Enterprise users can request help with implementation and troubleshooting.

5. Is Tilores suitable for non-technical users?

Tilores is built for API-based integration, so some technical knowledge is needed for setup. Companies without a development team may need external support during implementation.

6. How is pricing structured?

Pricing is based on the number of Unique Customer Records (UCRs). The Starter plan is free, while Growth and Enterprise plans require direct consultation for pricing based on usage.

Tilores Alternatives

Tilores focuses on real-time entity resolution and data unification, while other platforms offer different approaches for managing structured and unstructured data. The table below highlights key differences.

| Feature | Tilores | Segwise | Breadcrumb.ai | Dotdata |

|---|---|---|---|---|

| Core Functionality | Real-time entity resolution, data deduplication, and identity linking | AI-driven customer segmentation and data enrichment | Data tracking, entity matching, and knowledge graph structuring | Automated data science platform for feature engineering and predictive modeling |

| Best Fit | Businesses needing accurate, real-time data unification and fraud detection | Companies focused on AI-powered marketing segmentation and analytics | Organizations handling large volumes of unstructured data | Data science teams automating machine learning workflows |

| Pricing Model | Free plan available; paid tiers based on Unique Customer Records (UCRs) | Usage-based pricing depending on data volume | Custom pricing based on business needs | Subscription-based pricing for AI-powered automation |

| Integration Approach | API-driven, connects with CRMs, fraud detection tools, and data warehouses | API and cloud-based integrations for marketing and customer insights | Supports integration with knowledge management systems and cloud storage | Works with cloud platforms such as AWS, GCP, and Snowflake |

| Technical Requirements | Requires API integration; best for teams with development resources | Designed for marketing and data teams; minimal coding needed | Requires data science expertise for optimal results | Best for analysts and data scientists; no-code AI model creation |

Tilores is best for businesses that require real-time entity resolution and fraud detection. Segwise specializes in AI-powered customer segmentation, which is useful for marketing teams.

Breadcrumb.ai focuses on relationship mapping and unstructured data processing, benefiting companies handling large datasets with complex connections. Dotdata automates feature engineering and predictive modelling, making it a good choice for data science teams.

Each tool has a unique strength, making the right choice dependent on whether the focus is real-time data processing (Tilores), AI-driven segmentation (Segwise), structured entity mapping (Breadcrumb.ai), or automated data science workflows (Dotdata).

Summary of Tilores

Tilores was founded in 2021 by Hendrik Nehnes and Stefan Berkner and is headquartered in Berlin, Germany. The company focuses on real-time data unification and customer data integration, offering an API that helps businesses synchronize, normalize, and enrich customer records across multiple systems.

This technology is widely used in industries that depend on accurate data, such as financial services and e-commerce. In January 2022, Tilores secured $1.34 million in seed funding from investors, including Peak and Tiny.

The funding has supported the development of its API-based approach to data management, helping businesses maintain consistency across their databases. The platform builds huge customer records while reducing duplication and errors.

With a focus on scalability and efficiency, Tilores has become a valuable solution for companies looking to improve the quality and accuracy of their data without extensive infrastructure changes.

Conclusion

Tilores provides real-time entity resolution and data unification, making it a strong option for businesses that manage large volumes of customer records.

Its ability to merge fragmented data, eliminate duplicates, and detect fraud makes it well-suited for industries such as financial services, e-commerce, and regulatory compliance. The graph-based data model and API integration allow for seamless connections with existing systems, improving overall data accuracy.

Some businesses may face challenges during implementation, particularly those without dedicated development teams. Since the platform relies on an API-first approach, it is more suitable for organizations with technical expertise than those looking for a plug-and-play solution.

For companies handling large datasets and identity resolution needs, Tilores provides a structured and efficient way to manage information. We encourage testing the free Community Version to explore its capabilities. If you have experience with Tilores, sharing insights can help others make informed decisions.